42 - Learn to manage your money using personal finance spreadsheets

Reason for this Goal: Use personal finance spreadsheets developed using Microsoft Excel, the best financial tool ever invented! Excel, in its simplest form, is a tool for entering numbers and creating formulas to add, subtract, divide, and multiply rows and columns of numbers.

In its advanced form, Excel allows you to do detailed financial analysis and projections to manage your money well. Learning how to use Excel, or one of the other excellent tools available, is important if you are going to truly understand how money comes in and out of your life.

Personal Finance Spreadsheets for your personal budget and more!

Specifically, learning and using a financial tools such as personal finance spreadsheets will support you in your efforts to . . .

- Develop a personal budget to track your cash flow (your income and expenses)

- Track your assets (things you own)

- Track your liabilities (money you owe for the things you own)

- Know your net worth (your assets minus your liabilities)

- Do financial projections for the future (what-if scenarios)

- Analyze the difference in financial outcomes of different investment returns, including real estate

- And so much more

What we personally use spreadsheets for . . .

In our own life, we developed a spreadsheet in 1994 (the year my first daughter was born), that I've been maintaining and updating for more than 30 years. We can go back and look at our financial picture and pull out specific details related to the wide range of financial aspects of our life, including . . .

- Our cash flow, tracked monthly for the last 30 years including our salaried income, rental income, bonus income from our employers, home expenses, children expenses, living expenses, automotive, discretionary (restaurants, charity, vacations etc.), property taxes, utility payments etc.

- Our annualized Net Worth statement, capturing all of our asset classes (real estate, investments) and our liabilities (bank mortgages, home owner line of credit, car loans etc.)

- Long term financial projections for the real estate we own (www.gablesonthepark.ca)

- Value of our shares in company stock which we own (I participate in our companies program where they match a portion of the money we invest into company stock)

- The amount of money which we've helped our children with (i.e. education expenses, supporting their gymnastics and equestrian life)

- Retirement projections

- Rental expenses for our real estate properties (for tax purposes)

- Income Tax forms to record our annual Gross Rental income and total expenses

- Cash flow models for various real estate properties we've analyzed over the year

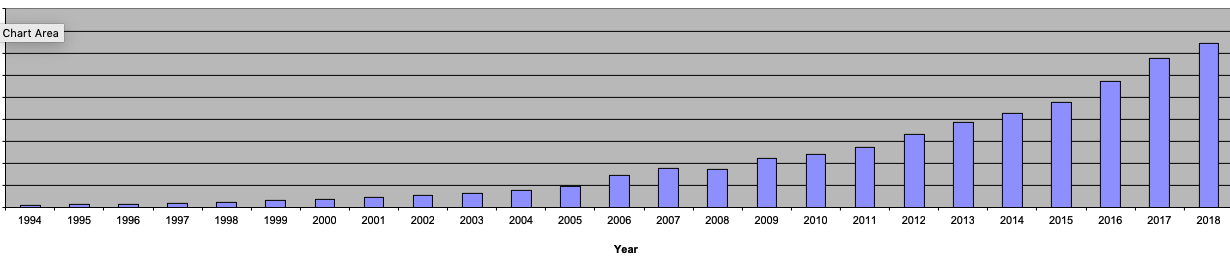

We have plotted much of this information in graphs that compare our Networth vs. our Liabilities as they change year over year. One of our favourite things to do is look at the growth in our assets using these graphs, inspiring us to keep making the smart money decisions to grow our net worth, ultimately allowing us to live out these 100 Life Goals!

This is an actual extract of one of our Excel graphs illustrating the growth of our Net Worth since 1994, using Personal Finance Spreadsheets to track it.

This is an actual extract of one of our Excel graphs illustrating the growth of our Net Worth since 1994, using Personal Finance Spreadsheets to track it.Most major banks, and many independent companies, offer financial tools that link to your accounts to help you manage and track your money. I prefer to keep with Excel. The thing I like about Excel is that it has stood the test of time, and any spreadsheets you develop now will likely be just as relevant 20 years from now.

Suggested Goal(s): Learn how to use Excel, and set up your own personal finance spreadsheets.

Your Outrageous Goal: Develop customized financial tools of your own.

Return to financial life goals or check out life goals they don't teach you at school!

Last updated: January 1, 2025