| Back to Back Issues Page |

|

|

Do you have financial goals? March 01, 2024 |

Hey!Goals and your wealth!Before we begin: If you enjoy his newsletter, please forward it along. If someone forwarded this to you, click here to sign up https://www.100goalsclub.com/life-goals-club-membership.html 100 Goals Club is a complimentary newsletter that specializes in helping you plan your life goals in 10 important areas. 1. Personal Development 2. Health and Fitness 3. Family and Friends 4. Hobbies and Passions 5. Financial 6. Career 7. Adventure 8. Travel 9. Lifestyle 10. Leaving a Legacy / Giving Back You are part of an exclusive group of goalsters (someone who understands the importance of life goals)! This email is going out to 1,899 email subscribers. You are receiving this email because you expressed an interest in life goals and receiving the Goal Setting Worksheet. Click here to order my accompanying 100 Life Goals Book > https://www.amazon.com/dp/1727154452 Remove your email by clicking unsubscribe below at any time. This newsletter focuses on your wealth goals for 2024 and specifically a goal to develop your financial plan

Wealth PlanThis month, Kathy and I decided to focus on some of our financial life goals and revisit a Wealth Plan we initiated in 2015 and last updated in 2019, with the help of a Wealth Planning Consultant at our bank.After 3 years of retirement, we want to ensure that our finances are optimized for the next 10 years and beyond, considering our real estate and financial assets. We've been fortunate to achieve the financial goals we wrote down at age 30, over 30 years ago. It reminded me of the importance of taking the time to really come up with a financial plan for your life. Quotes on goals"Setting financial goals is the first step toward turning the invisible into the visible. It transforms dreams into reality, providing a roadmap for a prosperous and fulfilling life." - Tony Robbins

"A goal without a plan is just a wish. By establishing clear and measurable financial goals, you empower yourself to take control of your financial destiny and create the life you desire." - Dave Ramsey

"Financial goals act as a compass for your money, guiding it towards the destinations that matter most to you. They give purpose to your earning, spending, and saving, ensuring that every financial decision aligns with your broader aspirations." - Suze Orman

"Your financial goals are the keys to unlocking the doors of your dreams. Without them, you may find yourself wandering aimlessly, but with a clear vision, you can confidently stride towards a future of abundance and security." - Robert Kiyosaki

"The journey to financial success begins with a destination in mind. Your goals serve as the coordinates, guiding you through the twists and turns of economic life, helping you navigate challenges and stay on course." - Jean Chatzky

"Financial goals are the building blocks of a stable and prosperous future. They provide the structure and discipline needed to weather life's uncertainties and build a foundation of financial well-being for yourself and generations to come." - Warren Buffett What are your financial life goals?The key to achieving good financial success is setting financial life goals. At age 30 and as part of my original 100 goals, I wrote out 4 specific financial goals to live our life by . . .1. Develop seven wealth guiding principles to follow

2. Invest monthly 10% of net income for long term growth

3. Achieve an average annual rate of return of > 10% on our equity investments

4. Retire at age 65 as a millionaire with net worth over $ 2 million dollars There are literally hundreds of strategies for developing significant financial wealth. They all start with a foundation of understanding money. Don't make the mistake of being careless with your money and your home finances. The benefit of being wise with your money and developing good financial habits now (see below) are critical to your future. As many of these 100 Life Goals require money to achieve, setting up sound money strategies early in life are important. Once you understand the power of compound interest (reference Goal 41 - Learn personal finance 101), you will look at money entirely differently. Every dollar you save and invest now will multiply many times over if you have decades remaining in your life. Think about that the next time you visit your local Starbucks or McDonalds. Here is a fundamental statement to getting wealthy over the long term: "Average returns sustained for an above-average period of time lead to extraordinary returns." For example, if you invest just $ 500/month for 30 years and average a 10% return in the stock market, you will have more than $ 1M with a total investments of $ 180,000 ($500/month x 12 months/year x 30 years), Increase your average rate of return to 12% and it will be worth more than $ 1.5M!

To explore this goal from my website, checkout . . . https://www.100goalsclub.com/life-goals- financial.html

Some of the things you'll read about here include: The 10 FINANCIAL LIFE GOALS at 100 Goals Club 41 - Learn personal finance 101 / good financial habits 42 - Learn a financial tool to manage your money 43 - Develop a budget 44 - Develop a good credit rating 45 - Track & develop your net worth 46 - Invest 10% of your income 47 - Find a financial adviser / mentor 48 - Own investment real estate 49 - Increase your income 50 - Plan your retirement as well as . . . The Rule of 72 Good Financial Habits A Summary of my investment philosophy and that of the 100 Goals Club

Visit https://www.100goalsclub.com/life-goals-financial.html

There are very few on-line newsletters that I subscribe to. The Financial Samurai is one of them. I read their regular newsletters and anticipate them on a regular basis. Below is the "About" section from their site . . . Financial Samurai is one of the leading personal finance sites in the world with roughly one million organic visitors a month. Everything is written based off firsthand experience because money is too important to be left up to pontification. Sam Dogen is the "Financial Samurai" Since his site was founded in 2009, more than 100 million visitors have stopped by Financial Samurai to learn, share, and grow. Financial Samurai consistently is ranked one of the top personal finance sites in the world due to its expertise, relevancy, and real-life storytelling. I recommend you join his 60,000+ free weekly newsletter to and read many of the excellent articles he has written.

https://www.financialsamurai.com Sam has an interesting life and shares openly his achievements and struggles in their families life, balancing his family's life along the way!

Two Levels of RichThe Financial Samurai posted a great article titled: "The Levels of Rich: One of which doesn't rely on Index Funds".

The article dives into some great topics, including: - Net Worth Breakdown by Levels of Wealth - Index Funds are Mostly for the Mass Affluent - Getting Rich is about Time and Risk Tradeoff - Index Funds are great for those on the Traditional Path to Retirement - The Rich Threshold for Happiness Check it out here . . . https://www.financialsamurai.com/the-two-levels-of-rich/

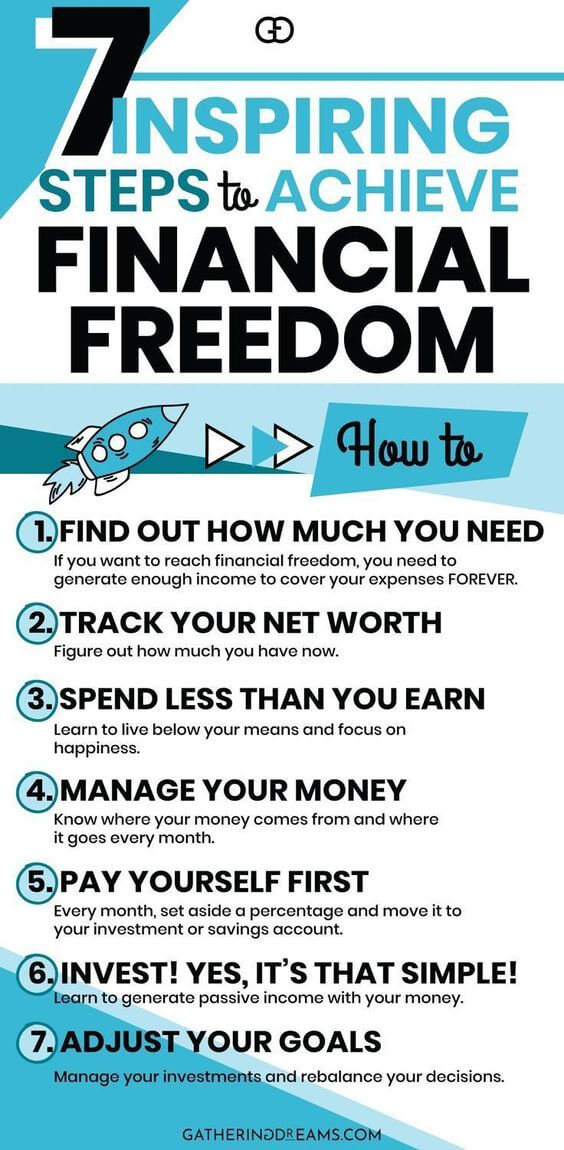

7 Steps to financial freedomLast year, Kathy and I prepared a financial presentation for our daughter and her husband to talk about some of the financial principles and steps that have helped us along the way. In preparing for the session, I searched the internet for a good graphic on the key steps to achieving financial independence.I picked the following graphic as an excellent summary about the key steps along the way.

Ensure you develop your own goals related to your finances. Explore my website and identify areas that you will develop goals that suit your own life. Finances are very personal and everyone's situation is different. While setting high expectations can be helpful to challenge yourself, you could also create too much stress in your life if you focus too much on unrealistic goals. To address this, you should set Target Goals which are realistic and Outrageous Goals which are "stretch" goals, giving yourself the ability to "dream"!

How many photos do you take?On a completely different topic, I take a LOT of photos. My iPhone has 89,748 photos on it!If I had to guess, I take more than 3,000 photos per year, more than 1/2 of them while vacationing. We've started a new Family Day tradition. In Canada, family day is the 3rd Monday in the month of February. Throughout the year, Kathy and I move our favourite photos into a "Best of 202X" album on our MacBook. We started doing this in 2021 and come up with the "Top 100 Photos" for the prior year. This year, I moved these photos (and videos) into iMovie and created a 20 minute slide show (with music) to highlight our favourite photos, events and moments we captured in 2023. On family day, we "presented" the top 100 photos to our children and their families. Our two daughters Karah and Maddie did the same thing. There are many benefits in doing this: - It allows you to focus on isolating your top memories from the year into a "manageable" number of photos/videos - It reminds you of all the things you've done in the prior year. If you're like me, I forget many of the significant events of the past year - It helps create the story line for achieving Goal # 98 to write or document your life story, under the goal category of Legacy goals. https://www.100goalsclub.com/write-your-life-story.html - It's a natural thing to celebrate family on Family Day and recount all the things you've done and achieved throughout the year. Consider if this is something you could incorporate as a tradition into your own life.

Next newsletter . . .In my upcoming newsletter scheduled for April 1st, I'll focus on my top 10 Top Tips to Improve yourself this year.

Brian Klodt founder of the 100 Goals Club CREATE YOUR ADVENTURES! https://www.100goalsclub.com P.S. Welcome to all new subscribers at the 100 Goals Club! Feel free to email me at brian@100goalsclub.com and say hi and tell me what's on your mind for your own life goals.

|

| Back to Back Issues Page |